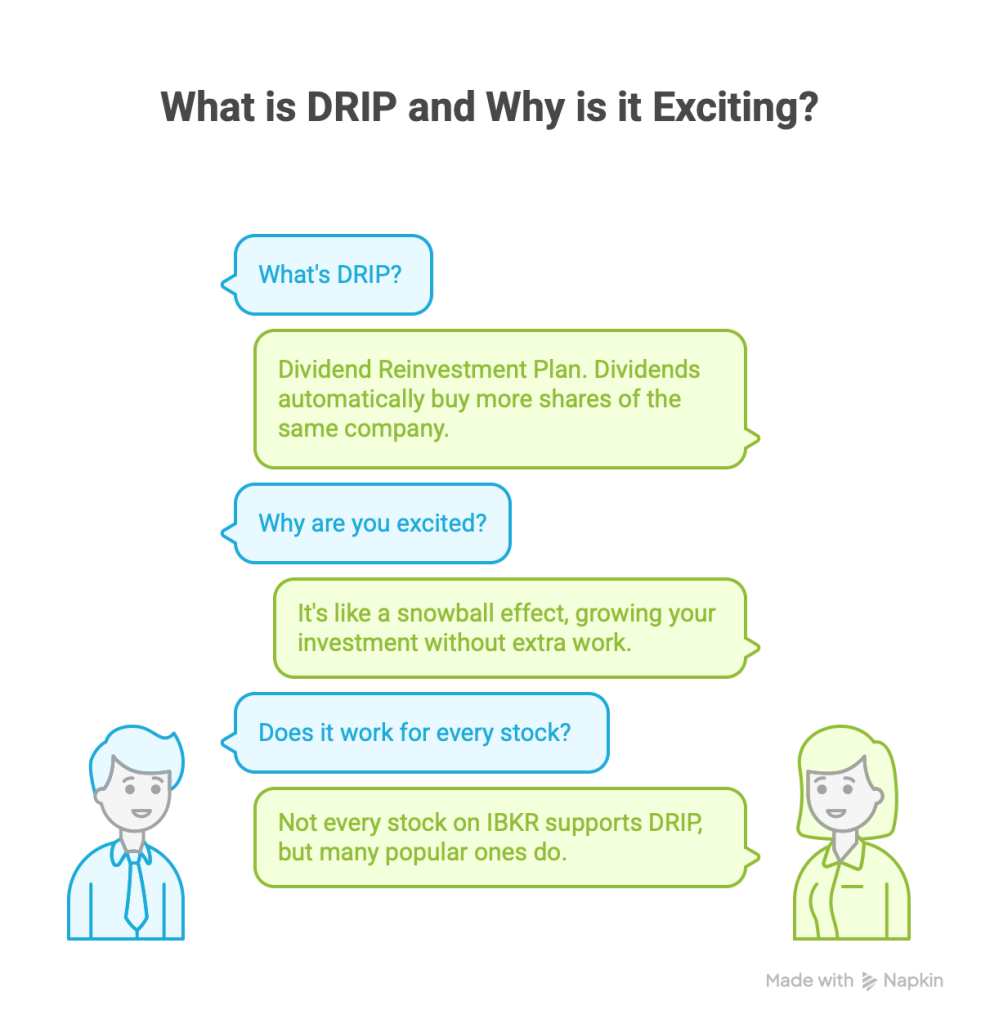

I’m getting back into dividend investing, and you know what got me excited again? Finding out that my broker (that’s the company that helps you buy stocks) has something called DRIP.

What’s DRIP and Why Am I Excited?

Here’s where it gets interesting. Normally, when you get dividend payments, that money just sits in your account. You could spend it on whatever you want. But with DRIP, those dividends automatically buy more shares of the same company for you.

Let me break down how powerful this is with a simple example:

Let’s say you own shares worth $1,000 that pay 3% dividends per year. That’s $30 in dividends annually. Without DRIP, you’d get that $30 in cash. With DRIP, that $30 buys more shares.

Now you own $1,030 worth of shares. Next year, you earn dividends on $1,030, not just $1,000. Then those dividends buy even more shares. It’s like a snowball rolling downhill, getting bigger and bigger without you doing anything.

The best part? Interactive Brokers (IBKR, my broker) can do this automatically for many stocks. I don’t have to remember to reinvest. I don’t have to do any extra work. The computer handles everything while I’m busy living my life.

One thing to note, though: not every single stock on IBKR supports DRIP, so I’ll need to check which ones do before I invest. But many popular dividend-paying stocks do support it, which gives me plenty of options.

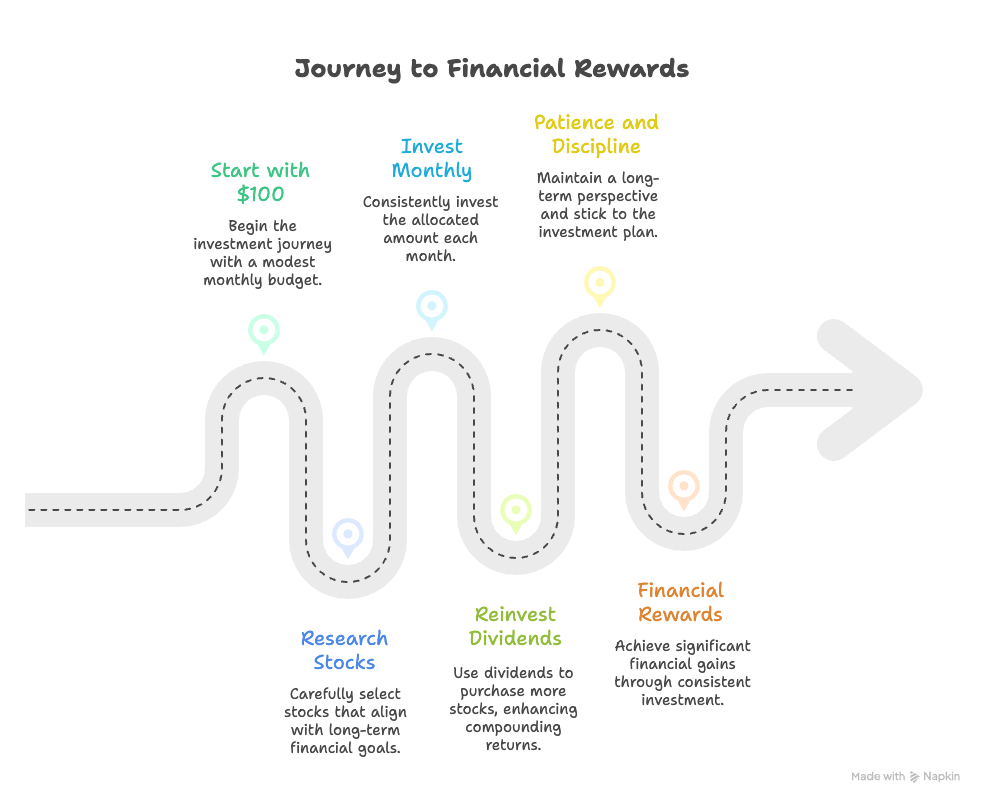

My Simple Plan: $100 a Month

Here’s my commitment: I’m investing $100 every single month. That’s roughly the cost of a few restaurant meals or a couple of movie outings with snacks. It’s not a huge amount, but that’s exactly the point. This is money I can consistently set aside without stressing about it.

Now, $100 doesn’t sound like much, right? But here’s the magic: over time, with dividends being reinvested and compound growth doing its thing, even modest monthly contributions can grow into something meaningful.

I’m not expecting to get rich quickly. I’m playing the long game here—thinking about where I’ll be in 10, 20, or even 30 years.

Since I’m working with smaller amounts, I’ll likely use fractional shares (i.e., buying parts of a share instead of whole shares). This lets me diversify across several companies, even with just $100 a month.

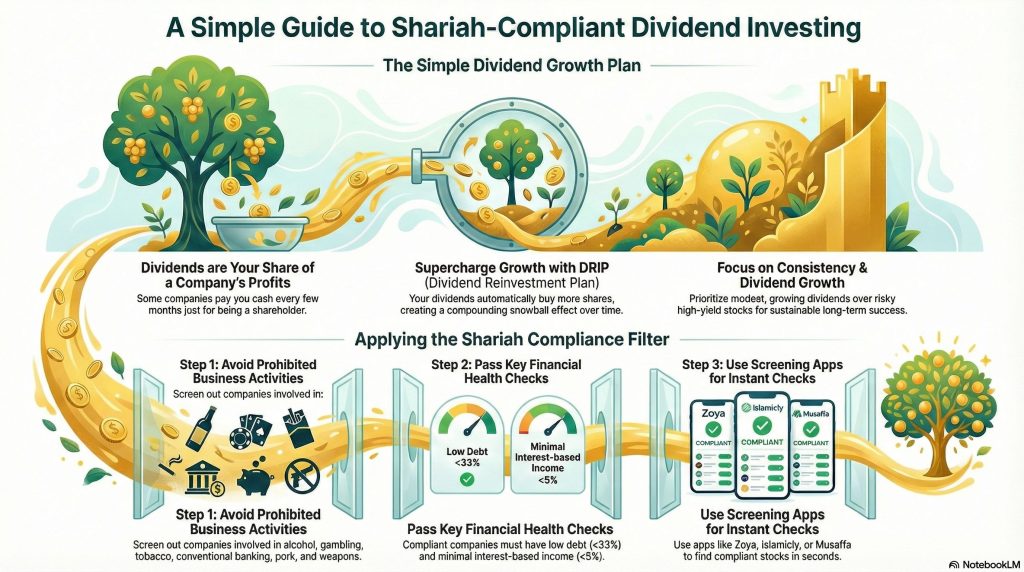

The Shariah Compliance Part (My Special Rules)

Now here’s where my situation gets a bit more specific: I follow Islamic investment guidelines, which means I need to invest in “Shariah-compliant” companies. Let me explain what that means in plain English.

In Islam, there are certain businesses Muslims are instructed to avoid. Think of it like dietary restrictions—just as some people don’t eat certain foods because of their beliefs, I don’t invest in certain businesses because of mine.

The businesses I need to avoid include:

- Companies that make or sell alcohol

- Gambling companies and casinos

- Tobacco companies

- Conventional banks and insurance companies (they deal heavily in interest, which isn’t allowed)

- Pork-related businesses

- Weapons manufacturers

- Some entertainment businesses that conflict with Islamic values

But it’s not just about what the company does. There are also financial rules:

- The company can’t have too much debt (borrowing). Specifically, total debt should be less than 33% of the company’s market value

- Less than 5% of the company’s income should come from interest

- Their unpaid bills (accounts receivable) shouldn’t be more than 45% of their total assets

These might sound like random numbers, but they actually make sense. Companies with low debt usually manage their finances well.

Companies not dependent on interest income tend to have real, solid business models. These filters often lead you to fundamentally strong businesses.

How I Find Shariah-Compliant Stocks (The Easy Way)

Nowadays, it’s pretty straightforward. Here are the methods I use:

Method 1: Check the Pre-Approved Lists

Smart scholars and financial experts have already done the heavy lifting. They’ve created indices (basically organized lists) of companies that meet Shariah requirements:

- Dow Jones Islamic Market Index

- S&P 500 Shariah

- MSCI Islamic Index

- FTSE Shariah Index

These aren’t investment recommendations, but they’re excellent starting points. I can browse these lists and research the companies that look interesting.

Method 2: Use Shariah Screening Apps (My Favorite)

This is honestly the easiest method. There are free phone apps specifically designed for this:

Zoya is probably the most user-friendly. You type in any company name (like “Apple” or “Microsoft”), and it immediately tells you if it’s Shariah-compliant or not. If it’s not compliant, the app explains why. Super simple.

Islamicly works similarly and also provides detailed information about why companies pass or fail the screening.

Musaffa goes even deeper, offering portfolio tracking and more detailed analysis if you want to really understand your investments.

These apps have been absolute game-changers. What used to require hours of digging through boring financial reports now takes literally 10 seconds.

Method 3: Look at What Islamic Funds Are Buying

Some investment companies specialize in Shariah-compliant investing. They have teams of experts who research and pick compliant stocks.

Companies like Wahed Invest, SP Funds, and Amana Mutual Funds publish lists of their holdings.

Even if I don’t invest in their funds directly, I can still see which companies they’ve chosen and research them myself.

My Investment Strategy (Keeping It Simple)

My approach isn’t complicated at all. I’m looking for companies that tick these boxes:

1. I understand what they do. If I can’t explain what a company does to a friend in simple terms, I probably shouldn’t invest in it. I want to own businesses whose products or services make sense to me.

2. They’ve been paying dividends for years. I’m not interested in companies that just started paying dividends last year. I want a track record—proof that they can maintain those payments through good times and bad.

3. The business seems like it’ll be around for decades. I’m thinking long-term here. Will people still need this company’s products in 2035? 2045? That’s what matters.

4. They pass the Shariah screening. This is non-negotiable for me. The company needs to align with my values.

5. The dividend seems sustainable. This is important. A company paying out 90% of its profits as dividends might struggle if business slows down. I prefer companies that pay out a reasonable percentage, leaving room for the business to grow and weather tough times.

Now, here’s something crucial I’ve learned: don’t chase the highest dividend yields.

When you’re browsing stocks, you might see Company A paying a 2.5% dividend and Company B paying 8%. Your first thought might be “Obviously I should pick Company B!” But hold on.

Super high dividends often come with super high risks. Maybe the company is struggling, and the stock price has dropped (making the yield look artificially high). Maybe they’re paying out more than they can afford. Maybe they’ll have to cut that dividend next year.

I’d much rather invest in a company paying a modest 2-3% dividend that increases every year than one paying 7-8% that might disappear when times get tough. When you’re reinvesting dividends for 20 or 30 years, dividend growth is way more valuable than a high starting yield.

Think of it this way: Would you rather get $100 today, or $50 today that grows by 10% every year? After 10 years, that growing payment is worth way more.

What I’m Hoping For (But Not Counting On)

Let me be realistic about my expectations. With $100 a month, I’m not going to become a millionaire next year. That’s not how this works.

But here’s what could realistically happen over time:

In 5-10 years: My monthly dividend payments might be enough to cover a nice dinner out or contribute to a short vacation. The portfolio would still be relatively small, but the snowball would be rolling.

In 15-20 years: The dividends might cover a monthly bill or two. Maybe they help with a child’s education costs or contribute meaningfully toward a major purchase, such as a down payment on a house.

In 25-30 years: This is where it gets interesting. The dividends could provide a meaningful chunk of retirement income, or at least significantly supplement other retirement savings.

Of course, these are just possibilities, not guarantees. Stock markets go up and down. Companies can cut dividends. Economic recessions happen. I get all that. But historically, patient investors who consistently invest in quality dividend-paying companies and reinvest those dividends have done pretty well over the long term.

The keyword there is “patient.”

The Hardest Part (Spoiler: It’s Not Picking Stocks)

You know what the hardest part of dividend investing is? It’s not analyzing financial statements. It’s not finding Shariah-compliant companies. It’s not even picking the “right” stocks.

The hardest part is simply showing up, month after month, year after year, and sticking with the plan.

It’s continuing to invest your $100 even when the market just dropped 10%, and everyone’s panicking.

It’s staying invested when your friend tells you about some cryptocurrency that “doubled in a wee,k” and you feel like you’re missing out.

It’s remembering why you started this in the first place when it feels like nothing’s happening and your portfolio isn’t growing fast enough.

That’s the real challenge. The patience. The consistency. The discipline to let time and compound growth do their thing without interfering.

So here’s to starting fresh—with better knowledge, clearer expectations, and a real commitment to seeing this through. Let’s check back in 2035 and see where this journey has taken me.

Wish me luck! 🎯

Note: This article shares my personal investment journey and isn’t financial advice. Always do your own research and consider talking to a qualified financial advisor before making investment decisions. Investment values can go down as well as up.