In Singapore’s diverse financial landscape, Islamic banking offers Muslims and ethically-minded individuals an alternative to conventional banking. These Shariah-compliant accounts adhere to Islamic principles while providing modern banking conveniences.

If you’re considering an Islamic savings account in Singapore, this comprehensive guide will walk you through everything you need to know—from available options and profit rates to application processes and strategies for maximizing returns.

Key Takeaways

- Three banks offer Islamic accounts in Singapore: OCBC (Al-Wadi’ah), Maybank (Savings-i), and CIMB (FastSaver-i, StarSaver-i, Hajj Savings-i).

- CIMB FastSaver-i offers the highest profit rates (up to 2.88% p.a.) compared to Maybank (0.15-0.3% p.a.) and OCBC (~0.2% p.a.).

- Minimum deposits range from S$500 (Maybank) to S$1,000 (OCBC, CIMB), with CIMB Hajj Savings-i requiring just S$125 monthly.

- Boost returns by crediting your salary, using bank credit cards, and combining with Islamic fixed deposits.

- CIMB is the only bank offering Zakat and Wakaf contributions via online banking.

- The application requires a standard ID, proof of address, and an initial deposit via FAST transfer.

- Islamic accounts offer lower returns than conventional accounts but provide Shariah compliance.

- Consider diversifying with other Shariah-compliant investments for better overall returns.

Understanding Islamic Banking Principles

Islamic banking follows specific principles that distinguish it from conventional banking:

- Wakalah (Agency): A contract where a person appoints a representative to undertake transactions on their behalf.

- Prohibition of Riba (Interest): Islamic finance prohibits charging or receiving interest on loans. Instead, banks earn through profit-sharing arrangements and fee-based services.

Key Islamic Banking Concepts:

- Wadiah (Safekeeping): A principle where the bank acts as a custodian of funds. In Wadiah Yad Dhamanah, the bank guarantees the safety of deposits.

- Mudarabah (Profit-sharing): A partnership where one partner invests in a business venture, while the other manages the business. Profits are shared according to a pre-agreed ratio.

- Murabahah (Cost-plus): A cost-plus financing arrangement where the financial institution purchases an asset and sells it to the customer at a markup price.

Available Islamic Savings Accounts in Singapore

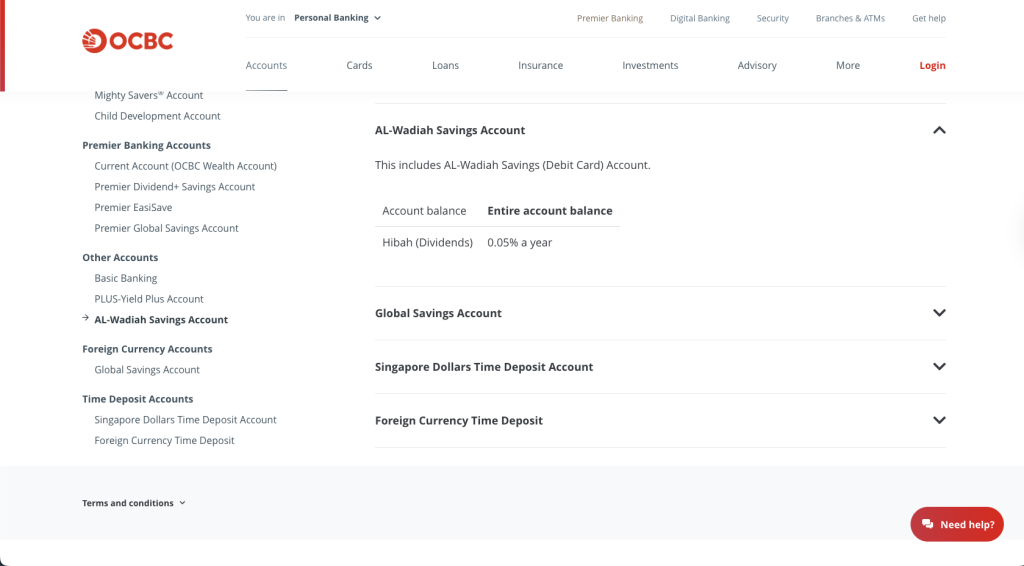

OCBC Al-Wadi’ah Savings Account

OCBC offers an Islamic savings account based on the Al-Wadi’ah principle, which operates in accordance with the Shariah concept of Al-Wadi’ah Yad Dhamanah (Guaranteed Safe Custody). This account requires a minimum initial deposit of S$1,000 and charges a service fee of S$2 per month if the average daily balance falls below S$1,000.

The Al-Wadi’ah principle means the bank acts as a custodian of your funds, guaranteeing the safety of your deposits. While OCBC doesn’t prominently market this account on its website, it continues to be available for those seeking Shariah-compliant banking options in Singapore.

Maybank Islamic Savings Accounts

Maybank offers Islamic banking products, including the iSAVvy Savings Account-i and regular Savings Account-i. These accounts operate on Shariah principles and provide:

- Potential bonus in hibah (gift) that may be distributed at the bank’s discretion

- 24-hour service with Maybank2u Online and Mobile Banking

- Free cash withdrawals at all Maybank ATMs and the ATM5 network in Singapore

- Money Lock feature for greater security

To open an account, you must be 16 years or older (younger individuals can open a Trust Account with a parent/guardian). The minimum deposit amount is relatively accessible at S$500.

CIMB Islamic Savings Accounts

CIMB offers several Shariah-compliant savings accounts:

CIMB FastSaver-i Account:

- A Shariah-compliant online savings account that earns high profit rates of up to 2.70% p.a. from your first dollar, with no cap on profit earned and no lock-in period

- Uses the Shariah concept of Murabahah (markup)

- No fall-below fees

CIMB StarSaver (Savings)-i Account:

- A Shariah-compliant savings account that gives competitive profit rates

- Uses the Shariah concept of Murabahah (mark-up)

- Requires a minimum initial deposit of S$1,000

CIMB Hajj Savings-i Account:

- A special Shariah-compliant account to help save for Hajj with profit and flexibility

- Minimum savings of S$125 per month

- Designed to help Muslims save for their pilgrimage to Mecca

Comparing Islamic Savings Accounts

Profit Rates (Hibah) (As of September 2025):

CIMB FastSaver-i:

- Base profit rate: up to 2.70% p.a.

- An additional 0.5% p.a. for salary crediting of a minimum of S$1,000

- Additional 1.0-1.5% p.a. for credit card spending (S$300-800 monthly)

- Combined maximum: up to 2.88% p.a. on the first S$25,000

Maybank Savings Account-i:

- Hibah rates between 0.15% to 0.3% p.a., depending on your deposit amount

- Lower than conventional accounts but adheres to Islamic principles

OCBC Al-Wadi’ah:

- Lower hibah rate, approximately 0.2% maximum p.a.

- Focuses on security rather than profit generation

Minimum Deposits and Features

| Account | Principle | Min. Deposit | Profit Rate | Monthly Fee | Features |

|---|---|---|---|---|---|

| OCBC Al-Wadi’ah | Wadiah | S$1,000 | ~0.2% p.a. | S$2 if below min. balance | Basic Islamic banking |

| Maybank Savings-i | Wadiah | S$500 | 0.15-0.3% p.a. | None | ATM access, online banking |

| CIMB FastSaver-i | Murabahah | S$1,000 | Up to 2.88% p.a. | None | No fall-below fees, FAST transfers |

| CIMB StarSaver-i | Murabahah | S$1,000 | Up to 2.38% p.a. | None | No fall-below fees, FAST transfers |

| CIMB Hajj Savings-i | Murabahah | S$125/month | Up to 2.0% p.a. | None | Specialized for Hajj savings |

How to Apply for Islamic Savings Accounts

Most Islamic savings accounts in Singapore require:

- Identification documents:

- Singapore NRIC for citizens and PRs

- Valid passport and work/employment pass for foreigners

- Proof of address:

- Utility bill, phone bill, or bank statement

- Must match the name on your ID documents

- Initial deposit:

- Varies by bank and account type (S$500-1,000)

- Can typically be transferred via FAST from another bank

Application Process

- OCBC Al-Wadi’ah Account:

- Visit an OCBC branch with the required documents

- Complete the application form and make an initial deposit

- Receive account details and access to online banking

- Maybank Savings Account-i:

- Download the Maybank2u SG app and tap on ‘More’ > ‘Apply’

- Apply via Singpass if you are a Singaporean or PR

- Alternatively, visit a Maybank branch with the required documents

- CIMB Islamic Accounts:

- Apply online or visit a CIMB branch

- Transfer the initial deposit via FAST from another bank

- Set up Digital Token through the CIMB Clicks Singapore mobile app

- A video call verification may be conducted

Maximizing Your ROI with Islamic Savings Accounts

Strategies to Increase Profit Rates

- Bundled Services:

- Credit your salary through GIRO (minimum S$1,000) to CIMB FastSaver-i for an additional 0.5% p.a.

- Use the CIMB Visa Signature Credit Card with a minimum spending of S$800 for an additional 1.5% p.a.

- Remember! Please pay the full amount of your monthly spending to avoid interest.

- Tiered Deposits:

- Some accounts offer higher rates for larger deposits

- Consider allocating funds across multiple Islamic accounts based on their profit structures

- Combine with Islamic Fixed Deposits:

- CIMB Why Wait Fixed Deposit-i offers up to 1.35% p.a. on 3-month and 6-month placements

- Create a ladder of fixed deposits for liquidity and a higher return

Zakat and Islamic Financial Planning

CIMB stands out by offering:

- The only bank in Singapore that allows Zakat and Wakaf Ilmu contributions via Internet Banking

This makes it easier to fulfill religious obligations while managing your finances.

Choosing the Best Islamic Savings Account

For Basic Banking Needs

Maybank Savings Account-i is ideal if:

- You prefer a lower initial deposit (S$500)

- You need ATM access and basic banking services

- You prioritize a bank with an established presence in Singapore

For Higher Returns

CIMB FastSaver-i offers the best profit rates if:

- You can credit your salary and use their credit card

- You don’t need frequent branch services or ATM access

- You’re comfortable with primarily online banking

For Specific Savings Goals

CIMB Hajj Savings-i is perfect if:

- You prefer a structured savings approach for religious purposes

- You’re saving specifically for Hajj or Umrah

- You can commit to regular monthly deposits (minimum S$125)

Limitations and Considerations

- Lower Profit Rates: Most Islamic savings accounts in Singapore have hibah rates lower than 0.34%, making them less competitive than conventional high-interest savings accounts

- Limited Banking Network: Islamic banking services have fewer branches and ATMs compared to conventional banks

- Diversification Need: Savings accounts alone may not be sufficient; consider diversifying into other Shariah-compliant investments

Conclusion

Islamic savings accounts in Singapore provide Muslims with banking options that align with their religious principles. While the profit rates are generally lower than conventional high-interest accounts, they offer peace of mind through Shariah compliance.

Among the available options, CIMB’s range of Islamic accounts currently offers the most competitive profit rates and features, especially the FastSaver-i account with its higher potential returns and no fall-below fees. Maybank provides a solid alternative with a lower entry barrier, while OCBC’s offering is more basic but comes from a well-established local bank.

For those serious about maximizing returns while maintaining Shariah compliance, consider a combination of Islamic savings accounts, fixed deposits, and other Shariah-compliant investments to create a balanced financial portfolio.

Remember that Islamic banking is not just about avoiding interest but embracing a financial system based on ethical principles, risk-sharing, and real economic activity. By choosing these accounts, you’re supporting the growth of ethical banking alternatives in Singapore’s financial landscape.